Week of 17/7/2023 Market Diary, Friday’s selloff nullified the gains made by $RSP and $IWM in the previous two days, potentially resulting in unrealized losses for recently added stocks. However, I believe the timing of the selling arrived at an opportune moment, as it prompted us to reassess our portfolio management over the weekend and gain a fresh perspective. The upcoming week will serve as a test of our proficiency in risk control.

Consider this food for thought: If you currently hold stocks in your portfolio with gains of less than 10%, a correction of less than 9% can easily erase those gains and bring the position back to breakeven. Now, the question is, 1) Do you have the confidence to sacrifice some of those gains and hold on for a potential higher base formation? 2) Does those positions have enough technical cushion to withstand a potential week of correction before your stop? 3) Or, would you may prefer to further scale out your big winning positions to finance this new position, while reducing the volatility of your portfolio’s p&l?

Worth reminding that If the market does not prove the position correct, it is still possible the market has not proven the position wrong. Your exposure and risk are much higher if you let the market prove you wrong instead of your actions removing positions systematically unless or until the market proves your position correct.

Thanks for reading.

PS: If you enjoy the above curated article, you may follow me on twitter (@jfsrevg) to get daily market diary, trading ideas and intermittent reflection on life as a trader.

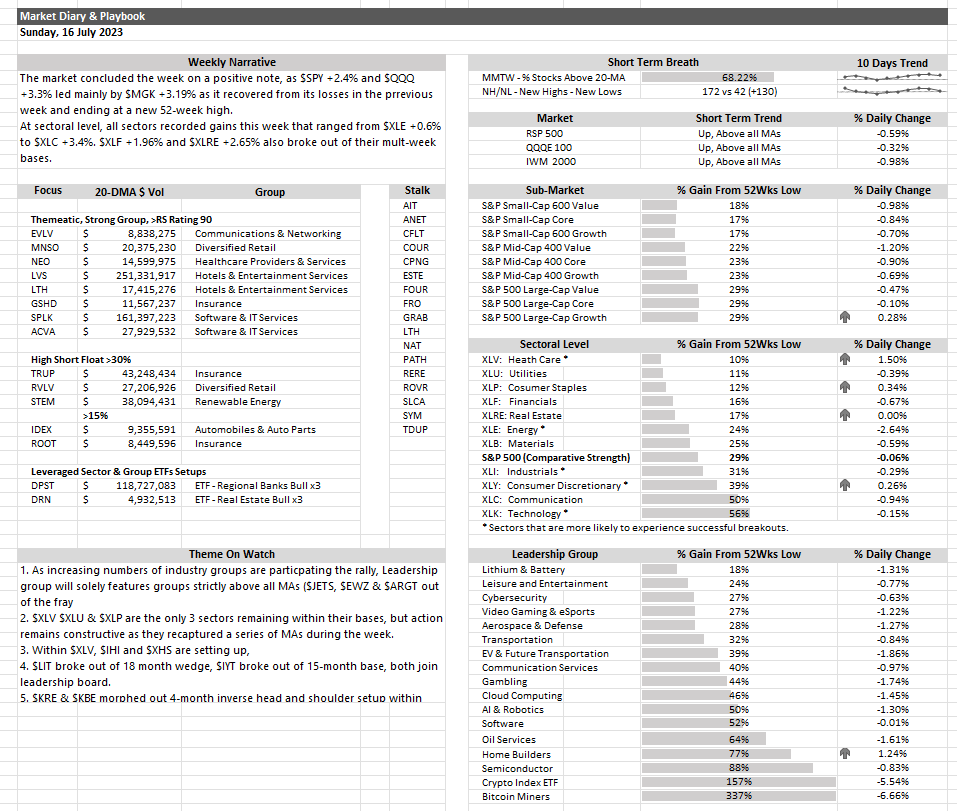

Week of 17/7/2023 Market Diary,

Friday’s selloff nullified the gains made by $RSP and $IWM in the previous two days, potentially resulting in unrealized losses for recently added stocks. However, I believe the timing of the selling arrived at an opportune moment, as it… pic.twitter.com/kXUvqeXZXX

— Jeff Sun, CFTe (@jfsrevg) July 16, 2023