The United States Investing Championship 2021 (began in 1983) just recently reported the winners of the 2021 competition, which involved 338 international traders. Prior top performers include Paul Tudor Jones, Dr. Edward O. Thorpe, Marty Schwartz, Frankie Joe, Tom Basso.

https://finance.yahoo.com/news/2021-united-states-investing-championship-131500406.html

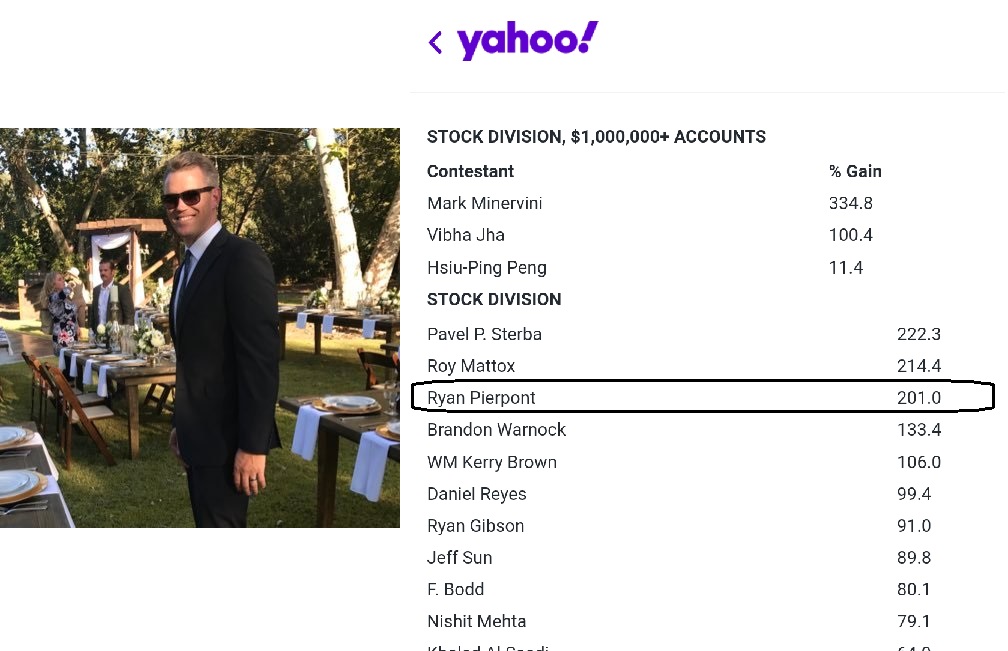

I am personally humbled to have grind out a 8th position (+89.8%), competing against the likes of veterans such as Mark Minervini (Winner of 1997 US Investing Championship), Roy Mattox (Portfolio Manager of IFS) and Christian Fromhertz (ex-director of Merrill Lynch Institutional Delta One trading desk). I will be writing a separate blog post to pen down my thought on the full year of full time trading, challenges and the thought process of my participation in USIC.

In trading, consistency and sustained performance is one of the key attributes to becoming successful. It is being consistently profitable year over year that allows you to put food on the table with such unique skillset that many yearn to achieve. Such ability gives you control over your time, life, and ultimate freedom.

Today, I am truly honored to have the permission to share this presentation pointers by Mr Ryan Pierpont that was featured on Market Chat by Richard Moglen. Mr Pierpont came in 3rd in consecutive years of US Investing Championship 2021 and 2022, raking up a consistent and colossal returns of +448% and 201% respectively. That is a total compounded return of 1,551% over 24 months! Most of the pointers highlighted by Mr Pierpont actually resonates to Jesse Livermore’s trading rules written in 1940.

Read further for some of his timeless trading rules.

Embrace what you NEED to hear, not what you WANT to hear

- Get used to taking losses (small ones). Don’t need ot be right all the time but large losses will CRUSH you.

- Listen to setups, not opinions. Ditch your opinions and those of others, they are worthless. Listen to the market, follow price.

- Price is primary, everything else is secondary & only used for conviction (fundamentals, indicators, etc.) Only price will make your rich.

- Stop trying to justify how great a company is.. it doesn’t mean shit if price doesn’t agree and is collapsing.

- Throw logic and economics/rationale out of the window, don’t over complicate things. Rarely does the market make sense, get used to it.

- Stop trying to figure out “why” something is moving. Who cares, just play dumb and follow the moeny.

- Be flexible and bend with the market. Adapt, don’t be stuck with tunnel vision. Things change on a dime. Be unbiased.

- Keep it simple, play dumber than a box of rocks. Simplicity really is key.

- Be great at one thing, not average at many things. Learn to specialize.

- At some point you can only learn so much on technical side, I don’t want to learn anything new there. Stay focused on being rock solid with discipline and executing your plan. THAT is where sustained success will come from, not from learning more technicals.

- If you use indicators, stack multiple things in your favor, don’t rely on just one. Indicators by themselves fail all the time.

- You need to have a passion for trading. If combing through charts is a “chore”, probably not for you.

- Get used to combing through hundreds/thousands of charts each week if you want to sustain success. Don’t have to trade, but need to stay in tune. Establish a routine.

- Learn to identify proper setups, study how stocks move. IT’S ALL ABOUT SETUPS, everything else is just noise.

- Look at historical movers, what did the charts look like before they made their big move? Pattern repeat. Do more of this instead of buying random things. Study.

- Avoid options, too many things go against you. Trading stock is hard enough.

- Be a leader and not a follower. Followers will have splashes of success but will have a hard time making it longer-term. Leaders can dig themselves out of holes and continue to ascend to greater heights.

- Making the trade your own dramatically increases your confidence level, and we all know mental capital is incredibly valuable.

- A baseline/foundation from a mentor is good, but you need to do a deep dive and innovate. Great creative and put your own spin on things.

- Scale your trading.

- Buy/Sell decisions should be made based on charts, not fluctuations on your account balance. STOP looking at your account balance. If you trade your plan correctly the money will take care of itself.

- Self-Awareness. Have to realize it only works a few times per year so you need to keep the greed in check. What kind of market are you in?

- Recognize the transition from a good period to not let drawdowns get too big. Spouse rule. Find other hobbies to kill time. I did a poor job in Q3 (2021).

- Learn to fade your emotions. When the smile on your face couldn’t get any bigger after a gain, probably a good sign to reduce lol.

- The less you trade, the faster you compound your account. Overtrading kills performance. Tortoise beats the hare, this stuff takes time.

- “Action” buys usually end in regret. Why bother? Wait for those quality setups.

- “If they want it, I want it…. if they don’t want it, I don’t want it.. simple as that.”

- Be prepared for every scenario. I always assume every trade will be a loser and am pleasantly surprised when they work.

- Focus on stocks that know how to make linear move, multiple up days in a row. Avoid choppy stocks.

- Selling into strength helps keep your equity curve on the offensive.

- You don’t need to be smart at all, in fact, the dumber you are the better you will perform. If you are a good ”listener” you can make a killing. Never argue with the market. Stop overanalyzing shit, there are either setups or there aren’t. Setups should be the basis of your buy decisions, nothing else.

- Prioritize your time to this. If you don’t have time, make time. I work my ass off at this and so should you.

- This number of setups in the market tells you when to buy, you don’t need an indicator for that.

- If a beginner, learn from people with a proven track record. Lots of people can say quotes that sound nice but you never see a chart. For all you know they could be a dog shit trader. Learn from people who have been in the trenches with proven success.

- And last but not least, you can do it! Let’s effing go!! Believe and bet on yourself! All it takes is one little breakthrough to keep you motivated. Anybody can do this. If you put in the work, you can make LIFE CHANGING MONEY.

If you would like to start studying the characteristics of some of the best performing stocks in the history of the market as advised by Ryan Pierpont, why not start with the 100 best performing stocks of 2021 that I have compiled as below!

I have consolidated the full list of ‘100 Best Stocks of 2021’ by @IBDinvestors on @tradingview in ascending order accordance to their % return in 2021. great for a #study week

🔁do give a retweet if it is helpful!https://t.co/2BW4diBVGn

— Jeff Sun, CFTe (@jeffsuntrading) January 6, 2022