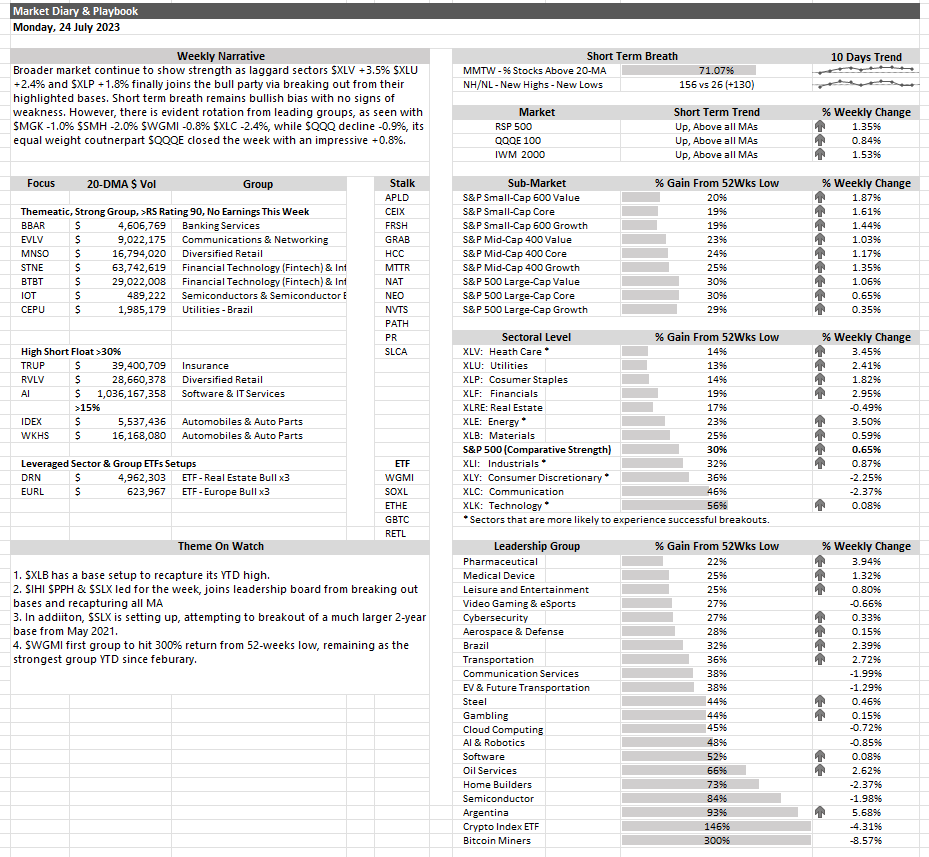

Broader market continue to show strength as laggard sectors $XLV +3.5% $XLU +2.4% and $XLP +1.8% finally joins the bull party via breaking out from their highlighted bases. Short term breath remains bullish bias with no signs of weakness. However, there is evident rotation from leading groups, as seen with $MGK -1.0% $SMH -2.0% $WGMI -0.8% $XLC -2.4%, while $QQQ decline -0.9%, its equal weight coutnerpart $QQQE closed the week with an impressive +0.8%.

The decision on whether sizing down from strength in the previous week was right or wrong remains to be seen. But one thing that is definite is the significant reduction in profit and loss volatility. As we face a slew of upcoming earnings, the outlook for the immediate week remains uncertain. Make sure to be aware of the earnings dates for the sizable holdings in your portfolio. Avoid the scenario where you may experience significant profits loss similar to what happened to $ASML, $TSM, and $AAL.

If you have a long watchlist of stocks and find the pullback to the 20-MA appealing, I strongly recommend re-evaluating their relative strength (RS) and identifying any lower high bearish divergences against its the higher high made in price. This is a great filtering exercise this week to your Aces. You will be surprise by the latest development of RS in many leading names.

Thanks for reading.

PS: If you enjoy the above curated article, you may follow me on twitter (@jfsrevg) to get daily market diary, trading ideas and intermittent reflection on life as a trader.

Week of 24/7/2023 Market Diary,

The decision on whether sizing down from strength in the previous week was right or wrong remains to be seen. But one thing that is definite is the significant reduction in profit and loss volatility. As we face a slew of upcoming earnings, the… pic.twitter.com/Oh1IxaTiqA

— Jeff Sun, CFTe (@jfsrevg) July 23, 2023