Investors will look for further confirmation of the private sector’s recovery from the pandemic as the earnings season gathers pace, with dozens of companies from a wide range of industries will report quarterly results this week. So far with one week in, companies are beating earnings estimates by a wide margin of more than 84%, according to Refinitiv.

Meanwhile, U.S. economic data will remain in focus as investors watch for further signals on the strength of the economy, with the latest reports on home sales and manufacturing activity topping the agenda.

Elsewhere, in Europe, markets are keeping an eye on the European Central Bank’s monetary policy meeting for further guidance on interest rates and stimulus.

Here is what you need to know to start your week.

S&P500 (US Market)

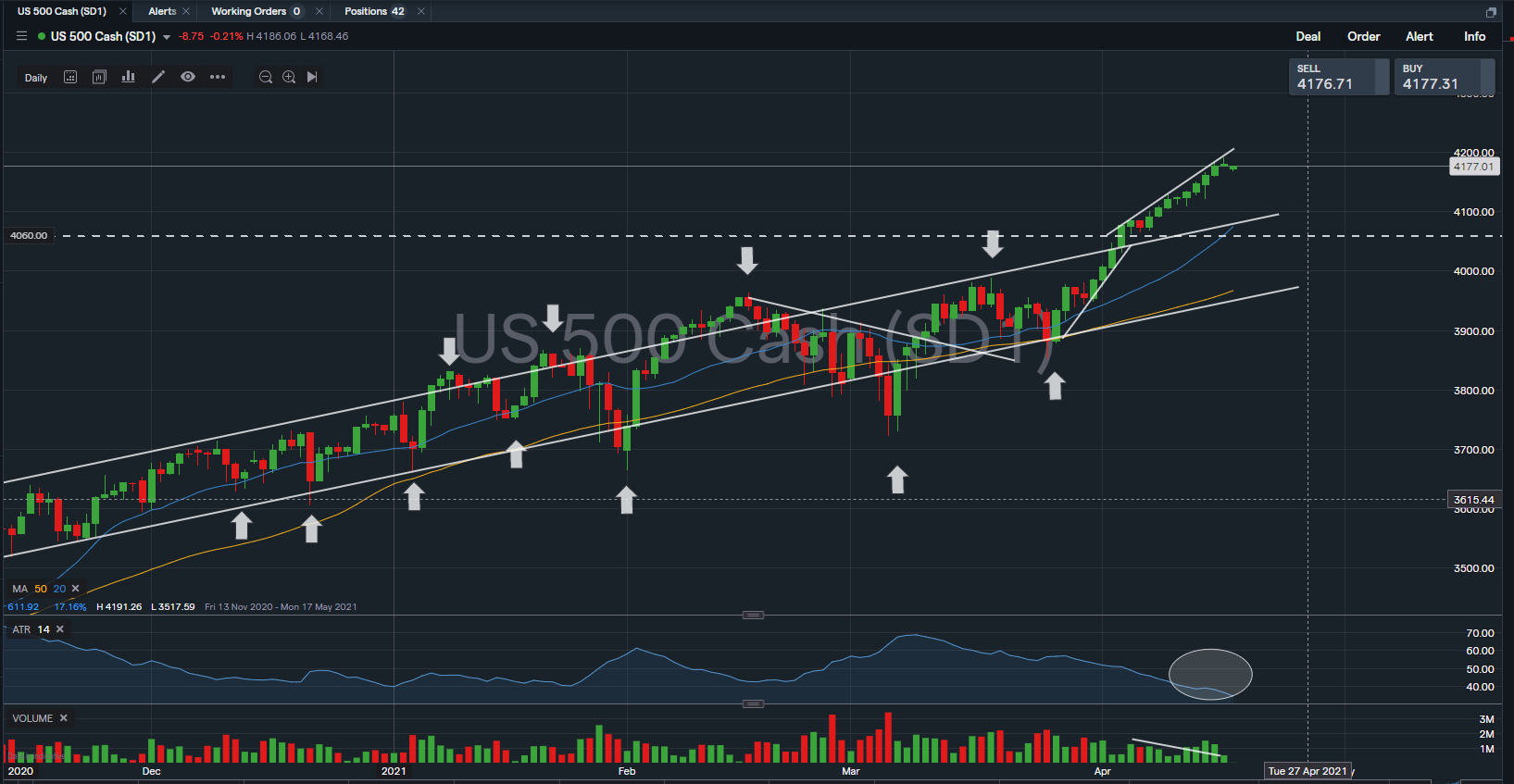

The benchmark index ($SPX) increased 1.41% (+58.3 points) to another record close, extending its weekly rally into its 4th consecutive session. The newly established all time high is now at 4,191 level for $SPX. US 10-year rates extended 5-week lows of 1.566%, despite strong inflation and employment data last week. In addition, housing starts rose to the highest level since 2006 last week, pointing to a strong rebound in both consumer spending and the jobs market.

The previously highlighted Bearish Divergence of $SPX remains valid, as sessional volume remains below its 50 days average range for the past week without any committed buying pressure reflected in this rally. A price retracement upon a eutrophic rally beyond the structure of a technical trend channel is always imminent on such scenario. However, the hypothesis of a short term correction for $SPX would remain healthy and strong for the bullish sentiment of the index.

The immediate support to watch for $SPX is now at 4,060 level, a break of the two weeks low.

Earnings Step Up into High Gear

There are about 80 S&P 500 companies reporting earnings in the week ahead, including 10 Dow stocks, in what will be the first big week of the first quarter earnings season.

In addition, this week’s earnings calendar also includes high-profile names like Coca-Cola ($KO), Johnson & Johnson) ($NJ), Procter & Gamble ($PG), Intel ($INTC), and IBM ($IBM), Snap ($SNAP), AT&T ($T), Verizon ($VZ), Lockheed Martin ($LMT), Halliburton ($HAL), Honeywell ($HON), and American Express ($AXP)

Most of the focus will be on Netflix ($NFLX), which is due to report its latest financial results after the closing bell on Tuesday. The streaming giant is forecast to report adjusted earnings per share (EPS) of $2.97 on revenue of $7.14 billion, according to estimates. NFLX shares hit a record high on Jan. 20, right after Q4 results, but has since slipped back. Options markets are pricing in a post-earnings move of 7% in the stock.

Earnings from battered airlines American Airlines ($AAL), United Airlines ($UAL), and Southwest Airlines ($:LUV) are also on the docket.

Flash U.S. PMIs

IHS Markit’s composite flash U.S. Purchasing Managers’ Index (PMI) for April is due on Friday, amid expectations for an increase to 59.9 from a reading of 59.7 in March The index, which measures the combined output of both the manufacturing and service sectors, is seen as a good guide to overall economic health.

In addition, this week’s rather light economic calendar also features the latest data on initial jobless claims, which fell to a new pre-pandemic low last week.

European Central Bank Policy Meeting

The European Central Bank is all but certain to keep interest rates at their current record low levels at the conclusion of its monetary policy meeting on Thursday. President Christine Lagarde will hold a closely watched press conference 45 minutes after the rate announcement as investors seek further clues on central bank’s future pace of bond purchases.

The ECB has boosted its bond buying program to prevent a rise in borrowing costs from derailing the region’s economy, however recent signs of a swift recovery could raise questions over when it will start to withdraw support.