This Wednesday’s Fed policy announcement will be the main directional driver for equity markets as investors will be expecting to hear if the central bank will begin withdrawing stimulus this year. Several policymakers have been calling for early tapering despite the recent slowdown in inflation numbers.

On the economic data front, notable publications include building permits and housing starts, the flash Markit PMI survey, new and existing home sales. Several other central banks will also hold meetings in the week ahead, including the Bank of Japan and the Bank of England.

Meanwhile, embattled Chinese property developer Evergrande (HK:3333) faces the prospect of defaulting on its debts, stoking fears of contagion that could spread to markets outside of China.

Here’s what you need to know to start your week.

With stocks struggling in this seasonally weak month for the market, all three major averages are negative month to date , but still sit less than 3% below their all-time highs.

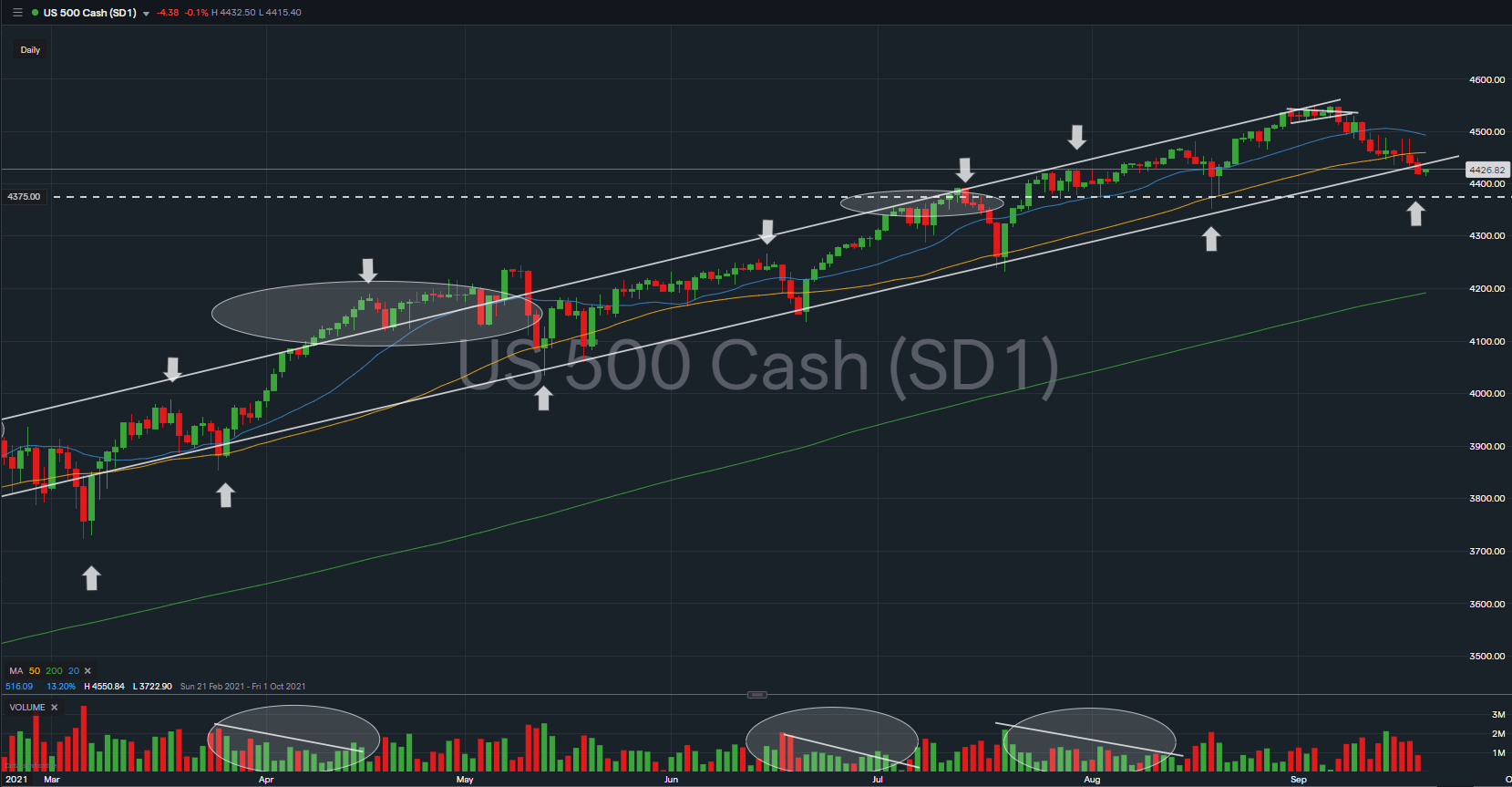

The immediate support to watch for $SPX this week is at 4,375 level; a significant 2ATR breakdown from its current up trend channel, a first sign of weakness in this mid-term rally.

Federal Reserve meeting

The Fed will begin its two-day policy meeting starting Tuesday ahead of its policy announcement on Wednesday afternoon and investors will be on the lookout for any details of the central bank’s plans to start paring back its $120 billion a month emergency stimulus program.

The Fed’s timeline for scaling back economic stimulus is important as it represents a first step towards eventual interest rate hikes.

Several Fed officials have said tapering should start this year, a view Fed Chair Jerome Powell may echo, while stressing a rate hike is still way off.

The Fed may stick to a cautious approach giving economic uncertainty due to rising COVID-19 cases and a weak jobs report for August.

Economic data

The U.S. data calendar for the week ahead is centered around housing figures, which are set to stabilize after a slight uptick in mortgage approvals for home purchases in recent weeks.

Data on housing starts and building permits data are due out on Tuesday, followed by figures on existing home sales on Wednesday and data on new home sales is due for release on Friday.

Market watchers will also be looking at Thursday’s report on initial jobless claims amid concerns over the hit to the economic recovery in the current quarter from the spread of the Delta coronavirus variant, especially among people who are hesitant to take vaccines.

Central bank meetings

Besides the Fed, several other major global central banks are also holding meetings in the coming days.

The Bank of Japan, which also meets on Tuesday and Wednesday, is widely expected to keep policy steady but may warn about growing risks to exports from supply disruptions.

On Thursday, Norway’s central bank is set to become the first from the developed world to hike rates since the pandemic, likely raising its main 0% rate to 0.25%.

The Bank of England is unlikely to change policy at its Thursday meeting but may indicate whether it still views inflation as transitory.

Crunch time for Evergrande

Indebted Chinese property developer Evergrande has a bond interest payment of $83.5 million due on Thursday, with investors pricing in a high likelihood of default.

That such a tiny amount could be the tipping point for a $355 billion behemoth with more than 1,300 developments across China and over $300 billion of liabilities shows how bad things are.

China’s second largest developer has been scrambling to raise cash, with fire sales on apartments and stake sales in its sprawling business network, but with little success.

Concerns that Evergrande could default on its debts is spilling over into China’s financial markets and even risks contagion that could spread to markets beyond China.