The Federal Reserve sent ripples across financial markets after its Wednesday meeting, when it signaled that interest rate hikes could come sooner than expected. US Dollar jumped, indices fell and bond yields moved to imply higher short-term interest rates in the future.

An appearance by Fed Chair Jerome Powell before Congress on this Tuesday will be in focus as are expectation for the tapering in bond-buying program to remain as a dominant trading theme this week and likely for the rest of the summer; as market participants digest the hawkish shift in policy guidance.

Investors in the US will also turn their attention to the June flash Markit PMI survey, with forecasts suggesting growth rates in both manufacturing and services sectors remained close to May’s all-time highs due to broader economic reopening and a labor market recovery

Here is what you need to know to start your week.

Major US Indices ended sharply lower last week, with the $DJI (-3.71%) and $SPX (-2.19%) recording their worst weekly performances since late October and late February, respectively. The tech-heavy $NDX index closed with slight positive (+0.26%).

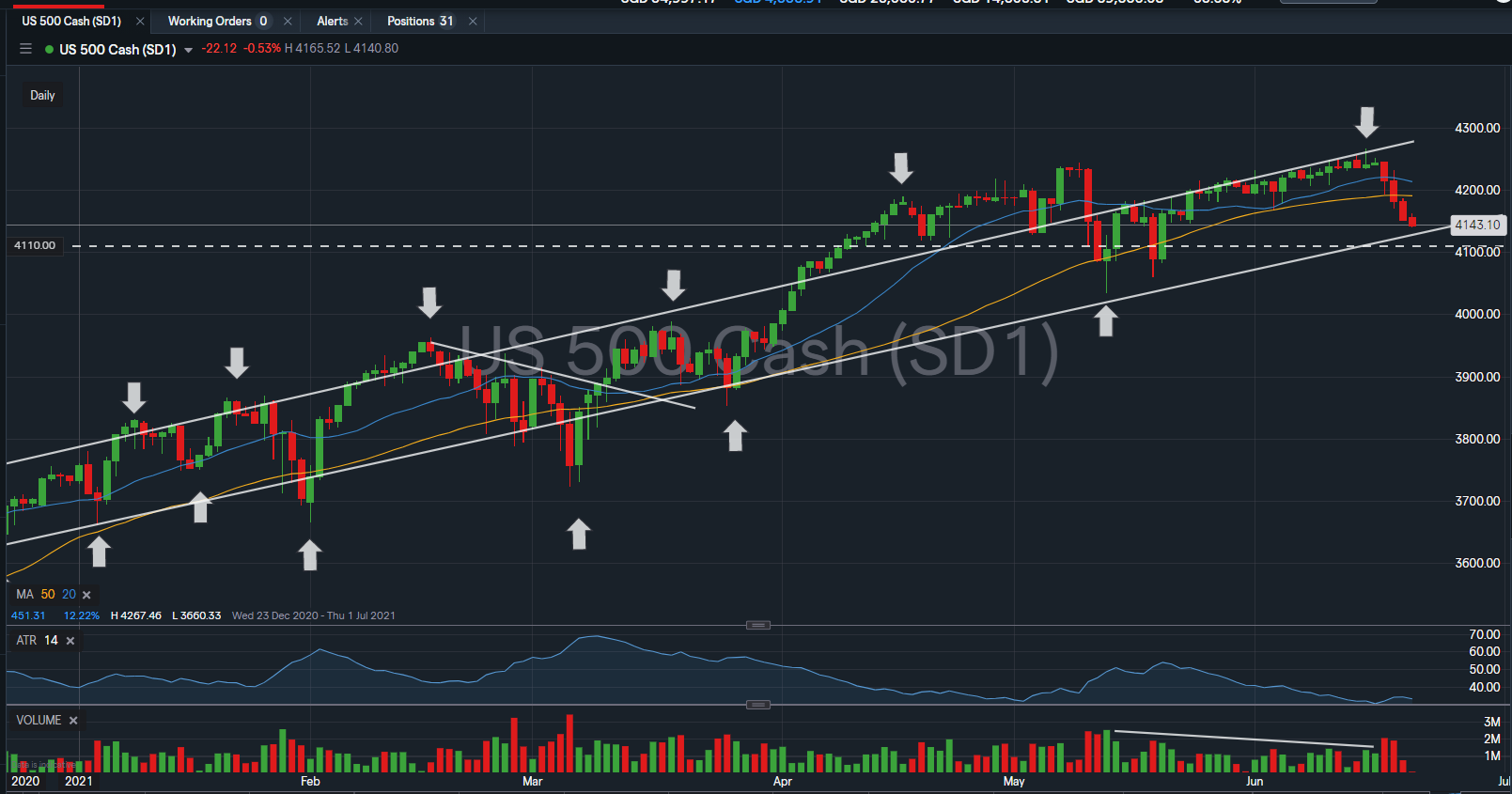

The declines were marked by a slide in value stocks, a pullback in some commodity prices as well as a rally in the dollar and U.S. government bonds. This decline was also signaled previously on the bearish divergence highlighted last week. $SPX have now currently breached its 20D and 50D Moving Averages on its third consecutive session for the first time since October 2020.

With $SPX now currently trading back on its mid-term trendline support, the immediate support to watch for $SPX this week is at 4,110 level; a high volume volatile price support zone set in May 2021.

Hawkish Fed shift

The Fed surprised markets last week when it projected two potential rate hikes in 2023, sooner than markets had anticipated and signaled that it was also reaching the point where it could begin talking about tapering its $120 billion a month stimulus program.

The shift in guidance was underlined when St. Louis Fed President James Bullard said on Friday that a move towards faster tightening of monetary policy was a “natural” response to economic growth and rising inflation as the economy reopens in the wake of the coronavirus pandemic.

The question of whether stronger than expected inflation would prompt the Fed to act sooner had already been hanging over financial markets in the run up to the policy meeting.

Powell testimony

Market participants will be closely watching comments by Fed Chair Jay Powell on Tuesday when he is due to testify, via satellite link, on the Fed’s emergency lending programs and current policies before the House Select Subcommittee on the Coronavirus Crisis.

In addition, several other Fed officials are due to make appearances during the week and their comments will also receive a lot of attention as markets look for fresh cues on the future direction of monetary policy.

Economic data

Investors will be paying close attention to the week’s upcoming economic data for clues on whether the recent surge in inflation – which saw consumer prices accelerate in May at the fastest rate in almost 13 years – is continuing.

Data on personal income and spending for May is due out on Friday, which contains the core PCE price index, supposedly the Fed’s favorite inflation gauge.

The economic calendar also features reports on new and existing home sales, durable goods orders, manufacturing and service sector activity and the weekly report on initial jobless claims, which is given close attention, given the uneven recovery in the labor market.